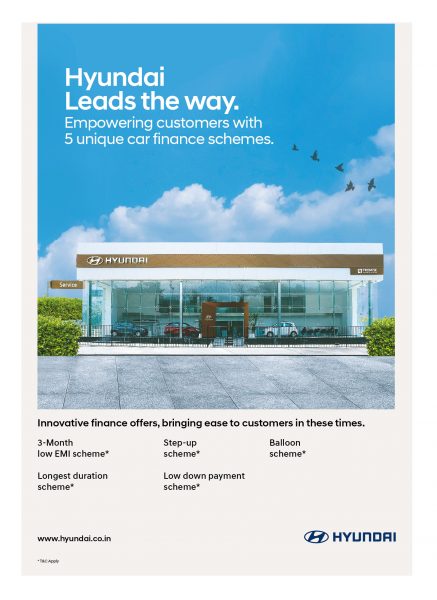

To push sale of its cars in the distressing time, Hyundai Motor India has announced 5 Unique Customer Centric Car Finance Schemes .

Details of Unique Customer Centric Car Finance Schemes available through various finance institutions are given below:

- 3 Months Low EMI Scheme: Customers can opt for Low EMIs for the first 3 Months and the balance amount in remaining equal EMIs for 3 Year, 4 Year & 5 Year loan tenures. This scheme is valid for all Hyundai models.

- Step-up Scheme: With this scheme, customers need to pay low EMI of Rs 1234/lac for the first year for a 7 year tenure loan. From the 2nd year onwards, the EMI would increase by 11% every year till the end of the loan tenure. This scheme is valid for all Hyundai models.

- Balloon Scheme: Customers who want to spend less in current times but are confident of paying higher amount later can opt for this scheme. Here customer would need to pay a lower EMI ( ~14 % Lower than normal EMI ) from 1st to 59th Month and the Last EMI will be 25% of Loan repayment. This scheme too is valid for all Hyundai models.

- Longest Duration Scheme: Customers who want to pay smallest amount monthly EMIs to ease up the repayment of loan amount throughout the loan tenure, can opt for up to 8 years of loan repayment duration. This scheme is valid for select Hyundai models.

- Low Down Payment Scheme: With the minimum possible down payment, customers can opt up to 100% On-road funding from financers under this scheme. This scheme is valid for select Hyundai Models.

Commenting on the announcement of Unique Customer Centric Car Finance Schemes, Mr. Tarun Garg, Director (Sales, Marketing and Service) said, “Hyundai has always been at the forefront of driving customer focused initiatives and yet again we are leading the way with 5 Unique Customer Centric Initiatives. Under these challenging times, it is vital that we empower customers with such programmes that ease their financial burdens and assist them in staying on track with life goals such as buying their favourite Hyundai Car.”